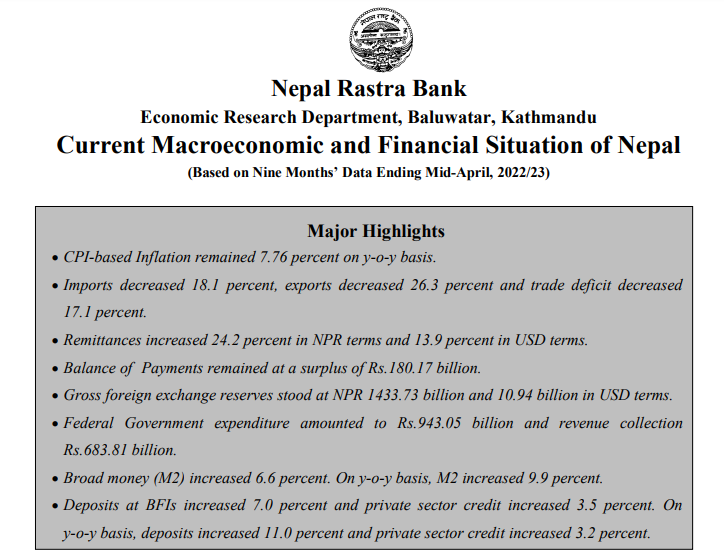

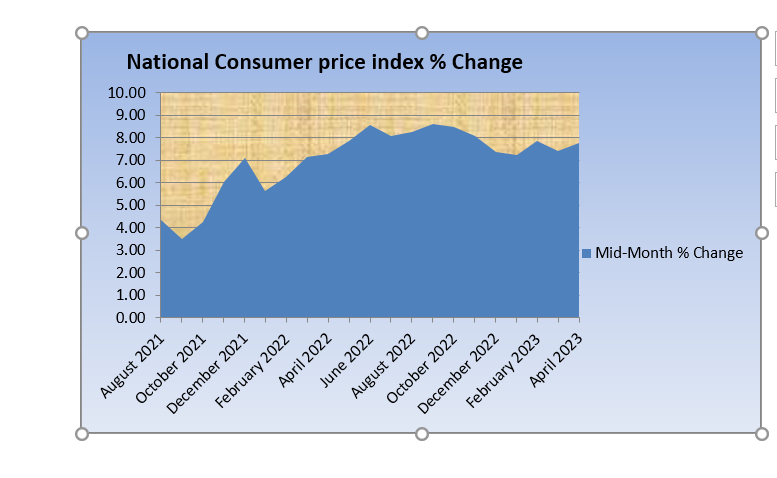

The Nepal Rastra Bank's monthly data reveals that the growth rate of consumer prices was at 7.76 percent in March, exceeding the annual target set by the National Bank for the current financial year. The National Bank's target was to maintain an average inflation rate of 7 percent for the year.

Throughout the current financial year, the rate of price increase has remained above 7 percent, with an average increase rate of 7.91 percent over nine months. In comparison to last February, the growth rate of prices in Chait has increased by 0.32 percent. During the same month of the previous year, the growth rate of prices was at 7.28 percent.

Over a period of nine months, the growth rate of the food and beverage group's prices was 6.93 percent, while the non-food and service group's prices increased by 8.42 percent. The report states that the annual point price index of the restaurant and hotel sub-group under the food and beverage group increased by 14.68 percent, marmalade by 14.67 percent, food and food products by 13.72 percent, fruit by 11 percent, and tobacco by 10.83 percent.

Similarly, under the non-food and services group, the annual point price index of the health sub-group increased by 10.39 percent, household goods by 9.54 percent, entertainment and culture by 8.81 percent, furnishings and household appliances by 8.74 percent, and education by 8.67 percent.

Merchandise exports decreased by 26.3 percent to Rs.118.28 billion during the nine months of 2022/23, compared to a 69.4 percent increase in the same period of the previous year. However, exports of zinc sheets, particle board, cardamom, woolen carpets, and readymade garments increased, while exports of soybeans oil, palm oil, oil cakes, textiles, and jute goods decreased in the review period. Exports to India decreased by 35.1 percent, while exports to China and other countries increased by 2.2 percent and 8.1 percent, respectively.

Merchandise imports decreased by 18.1 percent to Rs.1201.51 billion during the nine months of 2022/23, compared to a 32.0 percent increase a year ago. However, imports of chemical fertilizer, sponge iron, petroleum products, gold, and paper increased, while imports of transport equipment & parts, medicine, M.S. billet, telecommunication equipment and parts, other machinery, and parts, among others, decreased in the review period. Imports from India, China, and other countries decreased by 16.4 percent, 23.0 percent, and 19.4 percent, respectively.

The total trade deficit decreased by 17.1 percent to Rs.1083.23 billion during the nine months of 2022/23, after having increased by 28.5 percent in the corresponding period of the previous year. This shows a decrease in the export-import ratio to 9.8 percent in the review period from 10.9 percent in the corresponding period of the previous year, indicating a positive trend in the trade balance.

In the review period, the net services income maintained a deficit of Rs.56.26 billion, a decrease from the deficit of Rs.79.28 billion in the same period of the previous year.

During the review period, remittance inflows saw a notable increase of 24.2 percent to Rs.903.39 billion, compared to a decrease of 0.2 percent in the same period of the previous year. In terms of US Dollars, remittance inflows in the review period increased by 13.9 percent to 6.92 billion, in contrast to a decrease of 1.8 percent in the same period of the previous year.

During the review period, the interbank transactions of BFIs totaled Rs. 2982.69 billion on a turnover basis, which included Rs. 2715.90 billion of inter-bank transactions between commercial banks and Rs. 266.79 billion of inter-bank transactions among other financial institutions (excluding transactions between commercial banks). In the same period of the prior year, such transactions amounted to Rs. 2568.91 billion, including Rs. 2299.22 billion between commercial banks and Rs. 269.68 billion among other financial institutions (excluding transactions between commercial banks).

The value of Crude Oil Brent in the global market saw a 20.3 percent decrease, reaching US dollar 86.51 per barrel in mid-April 2023 from US dollar 108.49 per barrel a year prior. Conversely, the value of gold increased by 3.6 percent, reaching US dollar 2048.45 per ounce in mid-April 2023 from US dollar 1976.75 per ounce a year prior.

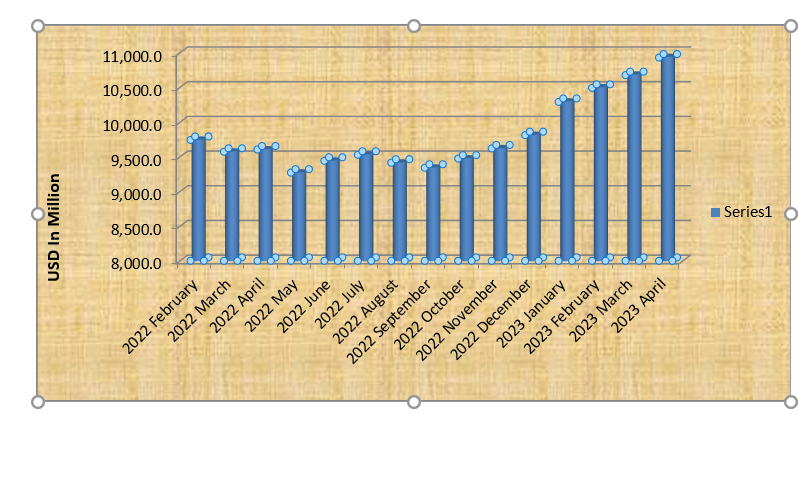

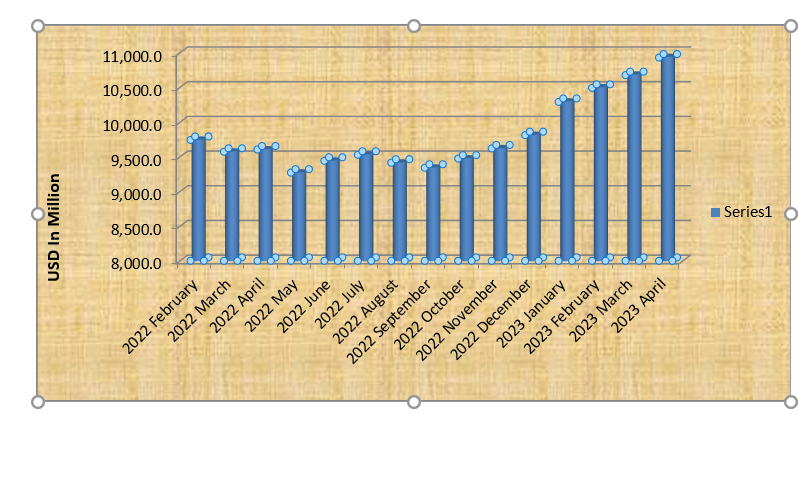

"The gross foreign exchange reserves rose by 17.9 percent to Rs.1433.73 billion in mid-April 2023 from Rs.1215.80 billion in mid-July 2022. In terms of US dollars, the gross foreign exchange reserves increased by 14.8 percent to 10.94 billion in mid-April 2023 from 9.54 billion in mid-July 2022.

Within the total foreign exchange reserves, the reserves held by the Nepal Rastra Bank (NRB) rose by 20.6 percent to Rs.1273.99 billion in mid-April 2023 from Rs.1056.39 billion in mid-July 2022. The reserves held by banks and financial institutions (except NRB) rose by 0.2 percent to Rs.159.74 billion in mid-April 2023 from Rs.159.41 billion in mid-July 2022. The Indian currency comprised 23.1 percent of the total reserves in mid-April 2023.

The foreign exchange reserves of the banking sector are sufficient to cover the potential merchandise imports for 11.0 months and merchandise and services imports for 9.4 months, based on the imports during the first nine months of 2022/23. In mid-April 2023, the ratios of reserves-to-GDP, reserves-to-imports, and reserves-to-M2 stood at 26.6 percent, 78.9 percent, and 24.4 percent, respectively. These ratios were 24.6 percent, 57.8 percent, and 22.1 percent, respectively, in mid-July 2022."

The Nepalese currency exhibited a depreciation of 2.69 percent vis-à-vis the US dollar in mid-April 2023 as compared to mid-July 2022, with a previous depreciation of 2.04 percent in the corresponding period of the previous year. The buying exchange rate per US dollar was Rs.131.03 in mid-April 2023, as compared to Rs.127.51 in mid-July 2022.

As per data from the Financial Comptroller General Office (FCGO), the Ministry of Finance registered a balance of Rs.943.05 billion. During the review period, the recurrent expenditure, capital expenditure, and financial management expenditure amounted to Rs.706.77 billion, Rs.107.24 billion, and Rs.129.04 billion, respectively.

During the review period, the total revenue mobilization of the Federal Government (including the amount to be transferred to provincial and local governments) stood at Rs.683.81 billion. The tax revenue amounted to Rs.616.12 billion and non-tax revenue Rs.67.69 billion in the review period.

In the review period, there was a 5.0 percent increase in domestic credit, compared to a 10.7 percent increase in the corresponding period of the previous year. As of mid-April 2023, domestic credit had increased by 8.6 percent year-on-year.

During the same review period, the Monetary Sector's claims on the private sector increased by 4.3 percent, as compared to a 13.7 percent increase in the corresponding period of the previous year. As of mid-April 2023, such claims had increased by 4.0 percent year-on-year.

In the ninth month of 2022/23, the average base rate of commercial banks experienced an increase to 10.48 percent from the previous year's 9.17 percent. During the same review month, commercial banks' weighted average deposit rate and lending rate stood at 8.26 percent and 12.84 percent respectively. This was an increase from 7.11 percent and 10.78 percent respectively a year ago.

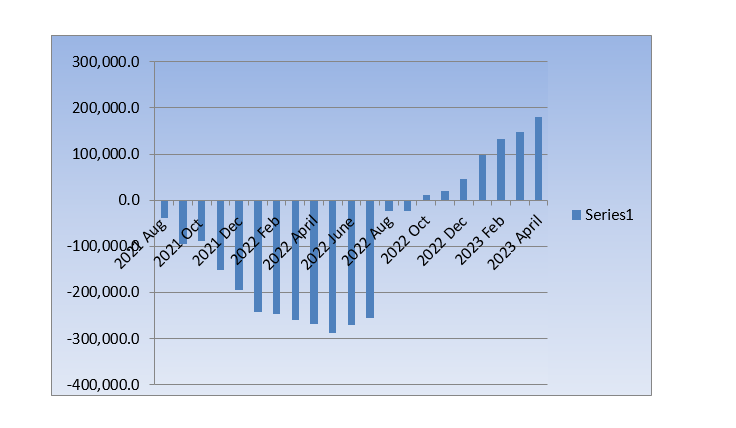

The Balance of Payments (BOP) maintained a surplus of Rs.180.17 billion in the review period, in contrast to a deficit of Rs.268.26 billion in the same period of the previous year. In terms of US Dollars, the BOP exhibited a surplus of 1.37 billion in the review period, compared to a deficit of 2.25 billion in the same period of the prior year. As compared to last year, the increase in remittance amount and decrease in imports has led to surplus. Current account (balance of payments) being in surplus means that the amount coming into the country is greater than the amount leaving the country.

During the review period, the current account is in deficit by 51.82 billion. In the same period of the previous year, the current account was in deficit by 510 billion. During the review period, the capital transfer decreased by 24 percent to 5.91 billion. In 9 months, the net foreign direct investment is only 2.62 billion rupees. Last year, foreign direct investment was 16.51 billion.

According to Nepal Rastra Bank, the year-on-year inflation rate remained at 7.76 percent. Gross foreign exchange reserves reached USD 10.94 billion, while total imports and exports declined by 18.1 percent and 26.3 percent, respectively. The trade deficit decreased by 17.1 percent during the same period.

IMF has suggested we still have not reached a time to formulate loose monetary policy.

Although the external indicators of the economy are positive, the fund claims that it is not time to make a loose monetary policy as the risks remain. The fund is of the opinion that the monetary policy should not be made flexible due to the fact that the risk of economic transition in the world market is still there, and the price increase is more than what the National Bank has indicated.

According to the fund, there is still a lot of financial space in Nepal. For this, the fund suggests that unnecessary expenses should be reduced and necessary expenses should be increased. The fund said that the government should not back down from taking tough decisions for the structural reforms of the economy. Although the contribution of imports to the revenue is huge now, the fund says that under the extended loan facility given by the IMF, it will help to reduce its burden.

Although the balance of payment and foreign cash reserves have shown positive and significant growth, the inflation rate still surpasses the target of 7% set by fiscal policy. The trade deficit continues to increase on a monthly basis and, most significantly, our revenue growth remains negative due to import restrictions. The government has resorted to increasing domestic and external debt to cover expenditures.

Monetary policy

NRB has indeed formulated the monetary policy in accordance with expectations. However, it is worth noting that they have not yet address the concerns raised by investors, particularly with regards to removing the cap of 12 core on share loan and the risk weighted assets on margin loan, which has remained at 150% instead of being reduced to 100%.

"The Federation of Nepalese Chambers of Commerce and Industry (FNCCI) has noted that the third quarter review of the monetary policy issued by the Nepal Rastra Bank (NRB) did not address all the concerns raised by industrialists. While the review acknowledges the challenges of bad credit risks, inflation, high interest rates, and others, the FNCCI believes that the prospect of an immediate market recovery is limited due to the absence of tangible and sufficient measures."

The third quarter monetary policy review for the fiscal year 2079-80, as presented by Mr. Manoj Gyawali, a prominent banker, is as follows:

1. The Bank has decided to lower the bank rate by one percentage point to 7.5 percent. In addition, all other policy rates and rates under the interest rate corridor will remain unchanged.

As a result of the reduction in bank rate, liquidity conditions will ease and interbank interest rates will likely decline. This, in turn, is expected to reduce the interest expenses for banks. Furthermore, it is anticipated that the interest rates for government bonds and securities will gradually decrease, providing some relief to the government's interest expenses.

2.The current practice of considering the bonds released by financial institutions and banks as sources (deposits) when determining the loan-to-deposit ratio will persist until Poush 2080

Impact: In this financial year, the CD Ratio, which has remained below 85.5%, has been eased with increasing remittances and declining credit demand, and has received an additional 6 months of ease. This will maintain the competition that has started slowly in credit expansion and loan customers will get loans at cheaper interest rates than before. If the banks are unable to see the long-term effects, they will start offering loans to each other at cheaper rates, due to which the spread of banking will decrease.

3. Based on the data released by the National Statistics Office, arrangements will be instituted to offer re-loan facilities within the available resources of the fund to provide assistance to borrowers associated with the economic sectors that have experienced negative growth in the last two quarters.

Effect: Troubled areas will be relieved. The bad loans of banking will decrease from the current rate.

4. Considering the underperformance of the real sector in the economy, it is advisable for banks and financial institutions to assess the cash flow of borrowers and restructure or reorganize loans pertaining to hotels and restaurants, animal husbandry, construction, and other sectors up to the value of Rs. 5 crores. Appropriate arrangements may be made accordingly

Impact: The identified sectors will be afforded some relief from immediate payment obligations, thereby potentially mitigating the burden of bad loan management for financial institutions. This development is anticipated to contribute positively to the profitability of these institutions.

5. Considering the challenges faced in loan repayment due to the relaxed state of the real sector, it has been decided that short-term and working capital loans may be extended for up to three months until the end of Asad 2080 without imposing any form of compensation or fee, based on appropriate need and justification.

Impact: There will be some relief to borrowers in distressed areas. Banking was still waiving the damages and fees to such borrowers. Earlier, there was a situation where the bankers would get a discount, but now there is a regulatory system.

6. In light of challenges faced by microfinance borrowers in repaying loans due to challenges in the real sector, measures will be taken to restructure or reschedule loans on a case-by-case basis by the end of Asad 2080. Such arrangements will be based on need and justification to ensure fair and appropriate support.

Impact: Microfinance borrowers will be able to shift some of the immediate payment burden and there will be some ease in microfinance bad debt management. This will help to some extent in maintaining the profitability of microfinance institutions.

To conclude, Nepal Rastra Bank has been successful in its goals so far. Despite being criticized in some situations, it has been able to keep the liquidity situation, inflation and foreign exchange balance in a rhythm. How the upcoming monetary policy will be presented is a matter of interest because it is very challenging.

अर्थ संसारमा प्रकाशित सामग्रीबारे कुनै गुनासो, सूचना तथा सुझाव भए हामीलाई [email protected] मा पठाउनु होला। *फेसबुक र ट्वीटरमार्फत पनि हामीसँग जोडिन सकिनेछ । हाम्रो *युटुब च्यानल पनि हेर्नु होला।

प्रतिक्रिया दिनुहोस