Foreword

We Nepalese, have always been resilient towards fighting foreign powers. We take pride in our rich history that we were never colonized. We have little moments within ourselves and take pride for what our ancestors did! However, every night before bed, a question lingers and makes my night sleepless. How a nation well sufficient within itself became an import-based nation? While growing up, I always heard the saying, “Nepal ma siyo pani bandaina” (Nepal even doesn’t produce needles). It was a hurtful fact to hear back then but thinking the situation is still relevant today makes me disappointed in myself.

The top export of our country is Human Resources. We cannot blame these amazing group of people because they are the ones that work hard and earn and send remittances which makes up for the most part our great nation’s GDP. However, knowing everyday people return home in their coffins makes me just even utterly disgusted in myself. Nepal is surrounded by economic hitmen. According to John Perkins, “Economic hit men (EHMs) are highly paid professionals who cheat countries around the globe out of trillions of dollars”. These are just external factors which influence a lot on us but we are screwed from our politicians. We tried all the available breed of politicians available to us but none of them have proved to be successful. Yes, I acknowledge we have grown a lot in terms of technology but we have still a long way to go.

After much thoughts and grinding my mind, I have dared to write this paper so that I can have my peace of mind back.

What is Money?

In order to understand Bitcoin, one must understand what money is and how it has been changing societies through thousand of years. Oxford dictionary defines money as, “Money n. (Current coin; metal stamped in pieces of portable form as a medium of exchange and measure of value. piece of money).”

Since the beginning of human civilization, we have utilised many commodities as a medium of exchange to meet our needs. These commodities that were available in the market could only be produced through labor. These fruits of labor one earned could be later exchanged for something else the individual needed or wanted. Barter system became the dominant economical transaction system where the fruits of labor between two individuals exchanged. However, there were many constraints in the system especially because trade was not possible until there was a meeting of interests. It was hard to conduct trade between a farmer and a blacksmith simply because the goods produced by the blacksmith was not immediately required by the farmer. In the other hand the goods obtained by the blacksmith would be perishable in nature and would not provide the same economic value as the axe or spear which can be used for an extended period of time for hunting or farming. Throughout human history, we as a species have found trust in a collective value in different commodities according to our geographical locations. These valuable commodities were later exchanged to fulfil our wants and desires. Seashells were used as commodity moneys in different parts of the world from Asia to North America. In many parts of the world cattle and salt were used as a form commodity money. Glass beads and Yam stones are other examples of different societies using different commodities as money. Gold was valued by the merchants’ trading goods from India to the Mediterranean. In England, the most popular form of money was the silver or as they called its purest form the Sterling. Gradually, people all around the world started to use gold and other metals as the dominant medium of exchange. These precious metals had distinct characteristics such as durability, transferability, portability and divisibility. These metals were not just metals now, they were precious metals as the demand was always high and the supply relatively low considering the time and effort required to find and mine these precious metals. Trades grew faster and larger as different humans could establish trust and exchange goods and services freely between them because they had a common point of interest, “Money”. Gold proved to be much superior than other metals because of its special indestructible feature which meant it could not only be used as a medium of exchange but saved and pass onto the next generation. Gold has a superior stock to flow ratio when compared to metals such as silvers and coppers which were more easily produced and hence lost their value over gold as the increase in supply led to debasement of their value. Stock to flow ratio is the current stock of commodity compared to the flow of new production. Stock to flow ratio assumes that scarcity drives value. Gold came as a winner among them and has been symbolic to money till this present day. Money had upgraded itself as a medium of exchange to a “store of value.”

All fiats lead to zero.

Fiat money (from Latin: fiat, "let it be done") is a type of money that is not backed by any commodity such as gold or silver, and typically declared by a decree from the government to be legal tender. During its hay day, the dictator of Roman republic, Julius Ceaser created the aureus coin which contained 8 grams of gold. This coin was widely accepted across the world and sustained its value for 75 years. One of the catalysts for changes in the Roman empire was when the empire started to clip coins of its population. Those clipped coins would be later melted and mixed with other impure materials to form a new coin. This was the first time when a currency was being debased. The clipping of coins and using impure materials to mix it resulted in a wide flow of new coins in the market without the same productivity. It was getting tougher for the empire to sustain all of its army and conquered lands. This reckless “coin clipping” and debasement would lead to the inevitable demise of the Roman empire. One of the first Christian emperor, Constantine, was the one who created the Solidus coin at 4.5 grams of gold in 312 AD. Solidus coin was used for 1123 years, the longest serving currency in the world it withstood several political & religious uncertainties but it sustained. During the gold standard, merchants used to deposit their gold with goldsmiths and were issued a certificate of gold that would verify the merchant has the available resources to complete the trade. This was one of the first type of paper currency as we moved from hard money to soft money. The paper did not hold value in itself but rather it carried a promise that the bearer of this certificate can be trusted. It was one of the first type fiat currencies to be issued. As the saying goes, “Absolute power corrupts absolutely”, the goldsmith realised what powers they hold in their hands and began issuing more certificates than their gold deposits as their certificate proved to be good as gold but without the labor, time and effort as it takes to produce the same amount of gold. These paper currencies gained popularity and paper currencies were issued mostly by governments and central banks controlled by the government.

After the second world war ended, a conference was held in Bretton woods, USA to determine a new way to make trade much more effective. It was agreed that the worlds currency will be pegged to the US Dollar and the US dollar will be pegged to the gold at US $ 35 per ounce. The war was over and it looked like we were moving into a period of peace and prosperity. However, this was not the case and the US would be involved in further more war efforts across the world from Korea to Vietnam. The US was having a hard time paying its war effort bills. In August 15, 1971, President Richard Nixon declared that US dollar would not be required to deposit gold for dollars in order to maintain the war. This led to a free fall of all the currencies as they were linked to the US dollar as well. Like the goldsmiths, now the governments could produce more certificates as per their will and this certificate was all that it mattered. The Weimer Republic or present-day Germany in 1923 supplied more of their currency the Papier mark in an effort to pay off their debts incurred during the first world war. Throughout history and in recent times we have many examples from Greece, Turkey, Venezuela, Argentina and Lebanon where excessive printing of currency has led to hyperinflation.

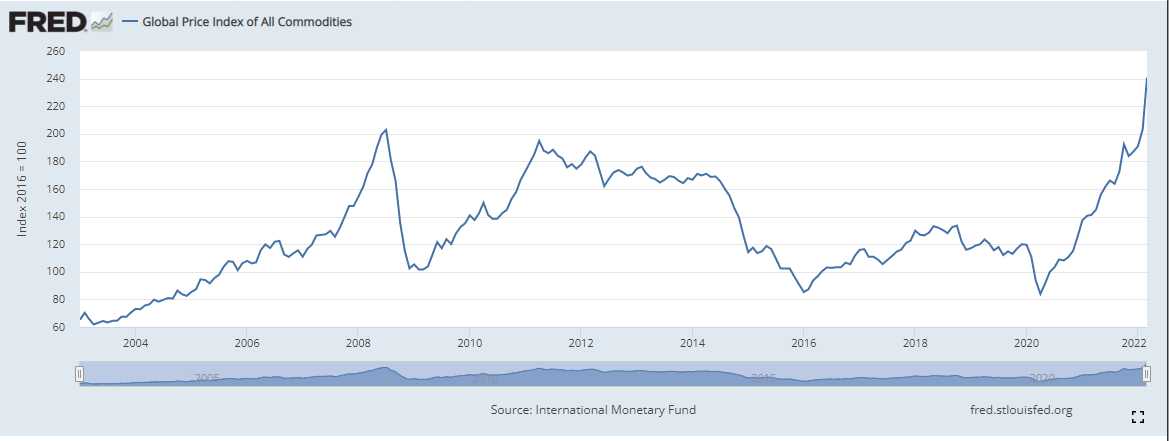

The trend continues today where governments and central banks still continue to print currency as they desire. To understand how central banks create money to stimulate the economy is relatively simple. In the United States, the Federal Reserve which is also the central Bank buys US government treasury bonds. These bonds are a promise that the government will pay back its debt amount after a certain period of time along with interest. These bonds were also referred as buying debts of the government. When an individual buys a bond, that bond is brought by the currency in circulation but when a federal reserve buys the bond it simply creates cash by providing money that didn’t exist before in exchange for bonds. This process is also known as quantitative easing (QE). Recently in March 2020, the Federal Reserve has pledged to buy unlimited US government bonds. In a credit-based economy, debt is the accelerant of economic growth. However, history has shown us time and again that a society where the currency is constantly debased possess a high risk of collapse.

The stimulus of the economy and quantitative easing may have provided a steady supply of liquidity in the market but the increment in currency circulation doesn’t necessarily mean an increment in the overall productivity. This has rather an adverse effect in the economy, too many currencies chasing fewer goods available in the market leading to the increase of price. The only way to get through this is borrow, borrow and borrow for today in the expense of our tomorrow. However, many economists particularly Keynesian economists argue that a credit-based economy is the only way to prosperity but in reality, individuals are getting less for their time and effort as their purchasing power is decreasing every day.

The Broken Wheel

In a world ruled by Keynesian economics and Modern Monetary Theory (MMT), the law of the land is spending your way to prosperity through Quantitative Easing (QE). However, reality presents us with some disturbing facts which we can not ignore even if we want. If we stick to the US in terms of our discussion, we can more closely absorb the economical wheel that’s moving our world. In 1970 Q3, US had a GDP to debt ratio at 34.86%. If we compare to 2021 Q3, GDP to Debt ratio stands at 122.5%. In simple terms, in order to produce $1 worth of economic goods we must take on a debt of $1.22. By the wonders of MMT, we are of course free to print as much as we can but it is clearly distinct that this house of cards is bound to fall. One may ask, if this is the case then why do the government collect taxes? They can just print more of the currency to keep the things going on. How taxation works in a Keynesian economics is the government don’t really want your money but they want to take the currency you have out of the circulation so that they can allocate those for other infrastructural goods. The United States of America maintains power simply because of the Petro-Dollar. Furthermore, the western powers try best to outsource its currency circulation to other countries as well, maintaining their dominant position overseas. Moreover, a complex foreign exchange process has been created just to facilitate transactions between countries. As per the Bank of International Settlements, in 2019, the International Bank of Settlements reported foreign exchange transactions worth US $ 6.6 Trillion per day whereas the same year the total Gross Domestic Product of the world combined was only US $ 87.61 Trillion. We are allocating resources to complex processes than productive goods for the society which can help us prosper. Central banks are highly regulated by the International Monetary Fund (IMF) and The World Bank, they impose certain guidelines to the central banks. Central banks also create a disruption in the market causing the market to lose its core principle of free market where buyers and sellers determine the economic value of their goods. The meddling by the central banks always causes either a surplus or shortage rendering resources misallocated. Window guidance have been constant ever since central banks came into play. During 1970, the central bank of Japan imposed their commercial banks to extend as much credit to the market which resulted the growth of speculative markets that saw growths of unprecedented levels. The value of the real estate in front of the Imperial Palace was more valuable than the whole of California. As the inevitable bubble burst, the era of speculation came to an end and resources that could have been allocated for productive goods were vanished in thin air through window guidance policies. Misallocation of resources is the key contributor to global wealth inequality and has been happening gradually from 1970 and the evidence is clearer than before. Dr Saifeadean further argues that in the Keynesian economy, you effectively need to work twice to earn your money, once when you work for it and once when you invest it to keep up with the rising prices just to keep your purchasing power intact. A new form of fiat currency is dawning upon us in the form of Central Bank Digital Currencies.

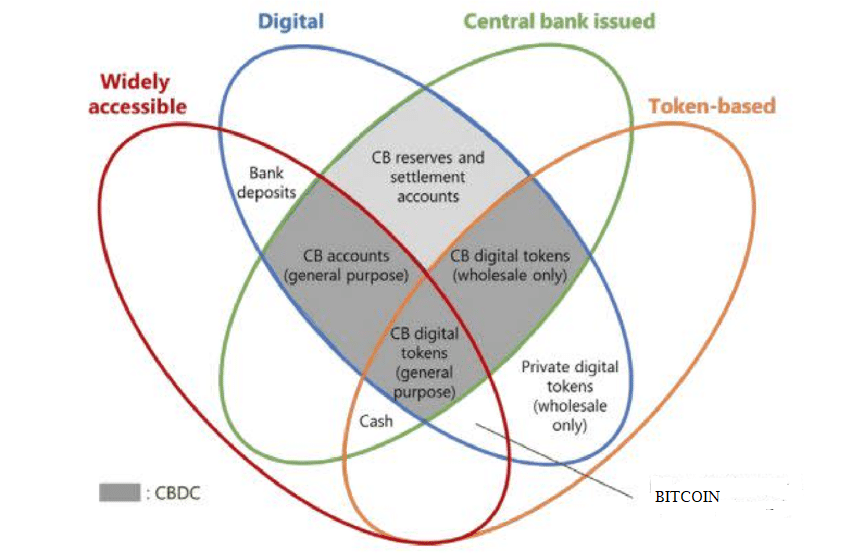

Central Bank Digital Currencies (CBDC) are currently marketed as the coming-of-age next financial technological revolution. However, these CBDCs are nothing but a surveillance system to keep track of every penny that you spend. Furthermore, governments and employers have rights to block any payments they seem unfit. In my opinion, this is a technological advancement in heading towards an authoritarian police state where the consumption of the fruits of labor earned by an individual are determined by the state and not the individual. I often keep wondering to myself how the people that we choose to serve us are now ruling us. It takes me back to Orwell’s book ‘1984’ and its famous quote, “Until they become conscious, they will never rebel.” CBDCs are not only surveillance money but they are also the outputs of the oncoming great reset where we switch from the petrodollar to the World Economic Forum’s approved CBDCs wiping out many developing nations in the process.

What is Bitcoin?

Bitcoin doesn’t have a headquarter. Bitcoin doesn’t have a CEO. Bitcoin doesn’t have a marketing department. It is controlled by no one yet it is controlled by everyone. All technologies start with an interesting idea and this was no different for Bitcoin either. Simply, Bitcoin is a peer-to-peer payment method where the transactions are not processed by a centralised entity such as banks or credit card companies but rather a decentralized network of computers around the world which verify and complete the transaction. Bitcoin is a distributed ledger where everyone participating in the network maintains the ledger and matches with other computers participating in the network to maintain the authenticity of the ledger. The ledger is public and everyone can check and verify it. New records are only updated in the ledger where all the computers have come to a consensus that the records are authentic. The Bitcoin network runs with a protocol of distributed consensus which has been credited a lot to solve the Byzantine Generals problem. Byzantine Generals problem is a problem where simply put to be is, “Reaching Agreement in the Presence of Faults”. Byzantine Generals problem is a problem faced by Byzantine generals while attacking a city, all of the generals should attack in the same time to avoid defeat. However, there are some generals who are traitors and act against the system, in this case all the generals must reach an agreement in different locations whether to attack or retreat. Messengers may be killed or stopped on their way while conveying their messages. It was a tremendous challenge to reach an agreement between the generals in the presence of an existing threat. Bitcoin solves this problem by maintaining a blockchain network where distributed computers all come to a consensus to agree upon the history of transactions in the blockchain. Any malicious attack or any forged entries will not be accepted upon by the consensus and hence won’t be recorded in the blockchain transaction. In the case of the Byzantine Generals, any false messages wouldn’t be accepted. Bitcoin miners are incentivized through a process called mining where they earn bitcoin for maintaining the network and validating the transactions. The blockchain network is founded upon the proof of work function where a miner validates a transaction and stores it in a block and announces on the blockchain where other miners verify and authenticate the block. This block is later tied to the previous block forming a chain of blocks. Users of the network have control over their bitcoin through digital signatures which are public, they cannot be forged and anyone can verify it. Since its inception, there can only be a total of 21 million Bitcoins ever into existence. Since Bitcoin is digital, one Bitcoin can be further divided into one hundred millionths of a Bitcoin. This smallest unit of the Bitcoin are called Satoshis.

Bitcoin is a trust free, decentralised peer to peer digital cash which you can easily send to any part of the world in minutes unlike the traditional banking system where wire transfers invented in the 1970s are still the dominant medium of transaction. It enables the users to eliminate middle men such as banks and remittance companies and send their funds directly to their intended users. As Greg Foss a credit market expert in the field of Bitcoin explains it, Bitcoin is simple maths. Bitcoin has a deflationary value meaning that fewer bitcoins can chase many goods. The diagram below depicts where Bitcoin stands in the money flower.

What’s in it for Nepal?

Nepal being a landlocked country has always depended upon its neighbours to provide them a safe trade route. However, we have been denied access to much needed trade routes time and again both in the north and south trade routes by our humongous economic giant neighbours. Most recently, in 2015 after the earthquake in Nepal, we were put on a blockade by the Indian Govt because we did not consider the national interest of the Indian Govt in the constitution of Nepal. Bitcoin is a guaranteed asset protection services which will safeguard your asset from any confiscation neither you can be denied access to the bitcoin network. Anyone with Internet connection can be part of the bitcoin network. We currently lack the abilities to defend in the land space but we can be proactive and defend ourselves in the cyber space against denial service of attacks by adopting to bitcoin.

On the 8th of November 2016, Indian Govt rendered Indian notes worth INR 500 and 1000 worthless. At that time, Nepal had billions worth of INR 500 and 1000 notes which were not converted by the Indian Govt. Billions of dollars worth of hard-earned Nepalese taxpayers’ money was wasted by the Central Bank of Nepal by holding unnecessary foreign fiat reserves. Bitcoin provides a safeguard on our reserves being untouchable. The ultimate form of sound and hard money.

Most of the countries exploit their natural resources to increase their wealth. Nepal is rich in water resources and has huge potential for hydro electricity. Nepal, in its winter months imports coal generated electricity from India. We can use our hydro energy plants and use it to mine Bitcoins and generate transaction as well as mining fees. We can distinctly convert our energy into acquiring assets in the cyberspace.

Bitcoin is an internet infrastructure located in the cyberspace accessible by anyone anywhere in the world. What makes this infrastructure unique are its characteristics of being limited, imputable and protected by mathematics and computers around the world running 24/7. It is high time for Nepal to establish a dominant position in this cyber space. Nepal can trade with other countries in minutes escaping the traditional fiat routes which normally takes weeks.

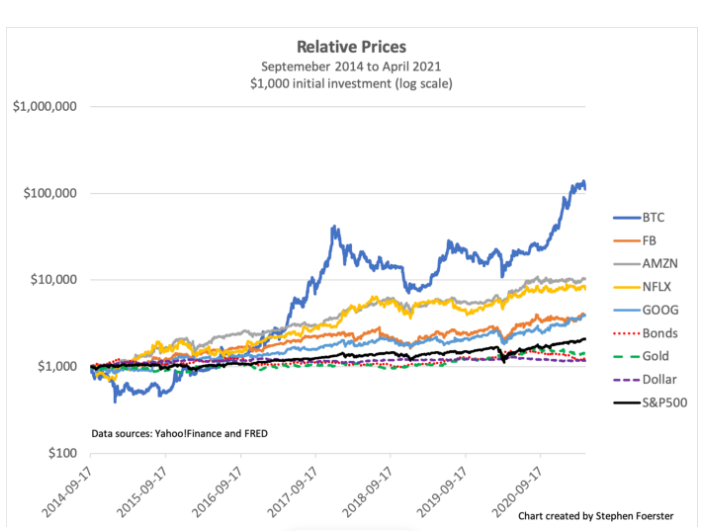

In July 2010, Bitcoin started trading at US $ 0.0008 and reached its all time high of US $ 68000 in Nov 2021. The reason that the value of Bitcoin has risen throughout the years its key component of being a sound money. It maintains a good stock to flow ratio as it is capped at 21 million Bitcoins. There can never be more than 21 million bitcoins in existence which makes it value grows over the time. Holding bitcoins in its balance sheet will only increase the wealth of Nepal.

(Source: Refer Reference List)

Bitcoin is an exponential technology which enables other technologies to develop on top of it. Historically speaking, electricity has been the most effective exponential technology which enabled other innovations on top of it. Our modern-day technology relies on the foundational technology of electricity. Similarly, Internet has been another exponential technology enabling millions of people around the world to share information with each other instantly through different mediums. And currently, Bitcoin is another exponential technology which enables the transfer of assets seamlessly beyond borders. We are still hundreds of years behind in railroads, we have just been loadshedding free recently now is the perfect time for Nepal to hold some bitcoins in its reserve. Nepal being an early adopter nation will strengthen its position strongly to have a grasp of this exponential technology.

Western economic giants flood the markets with fiat currencies which renders the savings value of small central banks to decrease. Central Banks can see their purchasing power of foreign reserves decrease as a result of global inflation. No other government or central bank, not IMF neither the World Bank group has any say on the limits of money printing by the US federal reserve. Every new dollar in circulation effectively decreases the purchasing power of the previous dollar. Nepal saving in Bitcoins will mean no other government or private entity can inflate the market and can retain its purchasing power.

Easy infiltration of foreign fiat in the name of donation to INGOs and NGOs has fueled a sense of disconnection between people living previously in harmony. The foreign fiat currencies such as US Dollar and the Euro holds quite a significant value in Nepal and are used to influence local as well as federal level decisions. Especially in the sector of foreign grants, no significant development can be seen in the people’s quality of lives. Easy influx of foreign fiat has created differences in the community socially and religiously. Fiat currencies posses a lot of persuading power to convince the population in their direction hence creating more social turbulences.

Departing Words

I, like most of my fellow Nepalese people like to believe that a better future lies in ahead of us and for coming generations. But the reality of the fact is much different than the we imagined or the one that we were promised through numerous revolutions. I truly believe it is time for us Nepalese to take the fate of our destiny in our own hands and break through the dollar cycle and adopt Bitcoin. Throughout our history, we have used an accounting system to create a mutual trust between complex group of human population. The first ever written words found was a sales bill or an accounting entry for a transaction of barley when barley was used as money. For the first time in history, we have a trust and verification mechanism in the cyber space accessible by any human from any where in the world. Trust helps to create prosperous and happy societies and help to advance human societies. Bitcoin is an internet banking infrastructure where millions of humans can safeguard their money in the cyberspace through trust in mathematics and verification through the proof of work. Their hard-earned money can neither be confiscated by any government nor the funds can be taken in the name of any charges just for holding the money. I hope the recent meeting with El Salvador of Nepal Rastra Bank was fruitful and we will see some positive step towards it.

References

Nakamoto, S. (2008). Bitcoin White Paper.

Ammous, S. (2018). The Bitcoin Standard: The Decentralized Alternative to Central Banking. Wiley Publishing.

21 Lessons- Gigi

Harrari, Y.N (2014). Sapiens: A Brief History of Mankind. Dvir Publishing House Ltd.

Casye, M., Crane, J., Gensler, G., Johnson, S., Narula, N. (2018). The Impact of Blockchain Technology on Finance: A Catalyst for Change (Geneva Reports on the World Economy).

Bis.org- https://www.bis.org/statistics/rpfx19_fx.htm

https://fred.stlouisfed.org/series/NYGDPMKTPCDWLD

worldbank.org

Perkins, J. (2004). Confessions of an Economic Hitman. Berrett-Koehler Publishers

Bitcoin Chart:

https://timesofindia.indiatimes.com/business/india-business/nepal-rastra-bank-stops-inr-exchange/articleshow/55466371.cms

अर्थ संसारमा प्रकाशित सामग्रीबारे कुनै गुनासो, सूचना तथा सुझाव भए हामीलाई [email protected] मा पठाउनु होला। *फेसबुक र ट्वीटरमार्फत पनि हामीसँग जोडिन सकिनेछ । हाम्रो *युटुब च्यानल पनि हेर्नु होला।

प्रतिक्रिया दिनुहोस